Airtel Payments Bank is an online banking subsidiary of Bharti Airtel. Airtel Payments Bank (APB) turned profitable in a very short span and has expanded banking points and operations across India. Customers can register to open a savings bank account by either going to its official website on a browser application or through the Airtel Thanks app. Today, we will be looking at the top five features of Airtel Payments Bank that you should know in case you were wondering about opening a savings account.

Airtel Payments Bank Top 5 Features

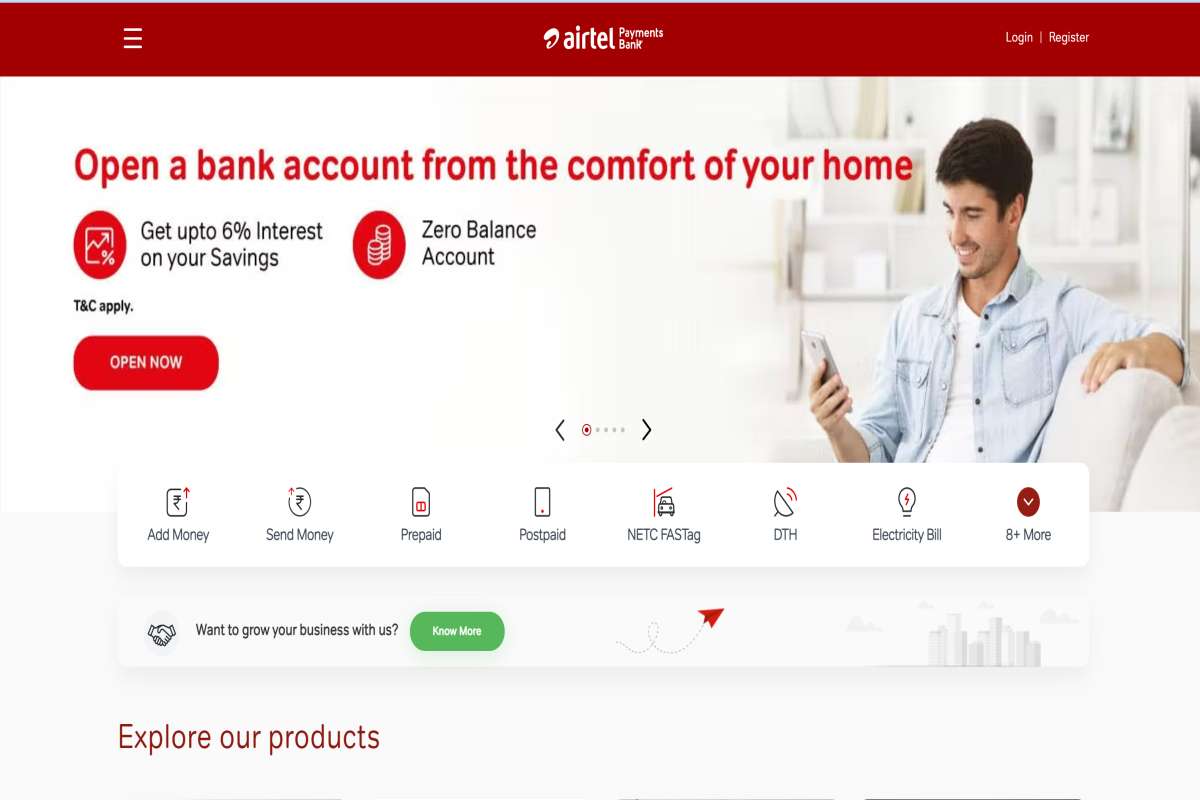

1) Savings Account Can be Opened from Home and is a Zero Balance Account

That’s right; you don’t need to get out of the comfort of your home to open a savings account with Airtel Payments Bank. As mentioned above, all that you need is an active internet connection and then either go to the Airtel Thanks app or to the Airtel website to register for a new account. APB doesn’t ask users to maintain any sort of minimum balance. It is a zero-balance savings account. You get up to 6% interest on your savings if you keep money in the account.

2) Airtel Safe Pay

Many people are scared of making payments online. However, that shouldn’t be the case with Airtel Payments Bank customers anymore. A little while back, Airtel said that it is introducing Airtel Safe Pay for APB customers. It is an additional layer of security over the 2FA system to ensure that your money is safe. This is a system that no other bank or payment wallet has incorporated into their system (which is surprising). Airtel doesn’t charge customers any additional fee for Airtel Safe Pay; it is just a feature of the service.

3) Airtel Payments Bank on WhatsApp

Airtel Payments Bank is available for customers on WhatsApp as well. You can literally get access to banking on WhatsApp with APB. You can recharge your mobile and pay your utility bills along with a lot more by registering yourself for WhatsApp banking with APB. You can save this number on your device - 8800688006 and send a Hi on WhatsApp to this number to start with WhatsApp banking.

4) Purchase Gold, Do Fixed Deposits and More

Airtel Payments Bank can help you do a lot of things. For example, you can invest in digital gold with Digi Gold and start that investment with just Re 1. You can buy and sell gold with Airtel Payments Bank anytime you want. With APB, customers can also make fixed deposits for Rs 500 to Rs 1,90,000. Airtel had also partnered with Axis Bank to digitise last-mile cash collection to ensure better cash management. Airtel has banking points across the nation, even in the country’s remotest corners, so you can also withdraw cash from these banking points. The company has also been installing micro ATM machines in Tier-2 cities to enable cash withdrawal.

5) Transfer Money and Pay Bills

The most basic feature of the APB is that it allows you to transfer money to other people’s bank accounts as well as lets you pay utility bills. You can also recharge FASTag and purchase insurance with the APB. These are the top five features of the APB. There are more features that you can explore by going to the official website of Airtel India.